The 4-Minute Rule for Paul B Insurance

Wiki Article

The Basic Principles Of Paul B Insurance

Table of ContentsThe Only Guide for Paul B InsuranceThe Best Strategy To Use For Paul B InsurancePaul B Insurance - An OverviewPaul B Insurance Fundamentals ExplainedPaul B Insurance - TruthsA Biased View of Paul B Insurance

Coinsurance: This is the portion (such as 20%) of a clinical charge that you pay; the remainder is covered by your medical insurance plan. Deductible: This is the amount you spend for covered healthcare prior to your insurance starts paying. Out-of-pocket maximum: This is the most you'll pay in one year, out of your very own pocket, for protected health and wellness care.

Out-of-pocket costs: These are all prices above a plan's costs that you have to pay, including copays, coinsurance as well as deductibles. Costs: This is the regular monthly amount you spend for your medical insurance strategy. Generally, the greater your costs, the lower your out-of-pocket costs such as copays as well as coinsurance (and the other way around).

By this step, you'll likely have your alternatives tightened down to simply a few plans. Here are some points to consider next: Inspect the range of services, Return to that recap of advantages to see if any one of the plans cover a larger scope of services. Some might have better insurance coverage for points like physical treatment, fertility treatments or mental health care, while others might have better emergency insurance coverage.

The Single Strategy To Use For Paul B Insurance

In some instances, calling the strategies' customer care line may be the most effective way to obtain your concerns responded to. Compose your questions down in advance of time, as well as have a pen or electronic tool convenient to record the responses. Below are some instances of what you might ask: I take a particular drug.Make certain any kind of strategy you pick will spend for your normal and also required treatment, like prescriptions as well as specialists.

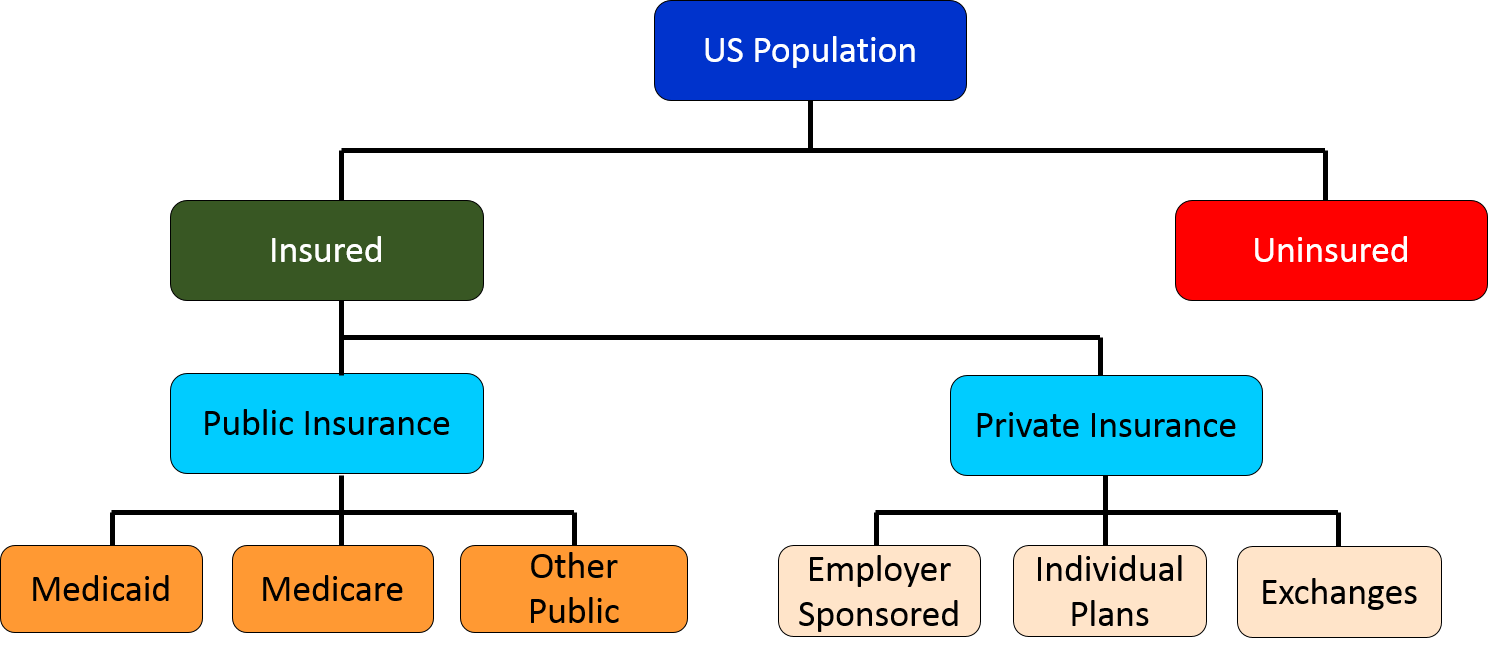

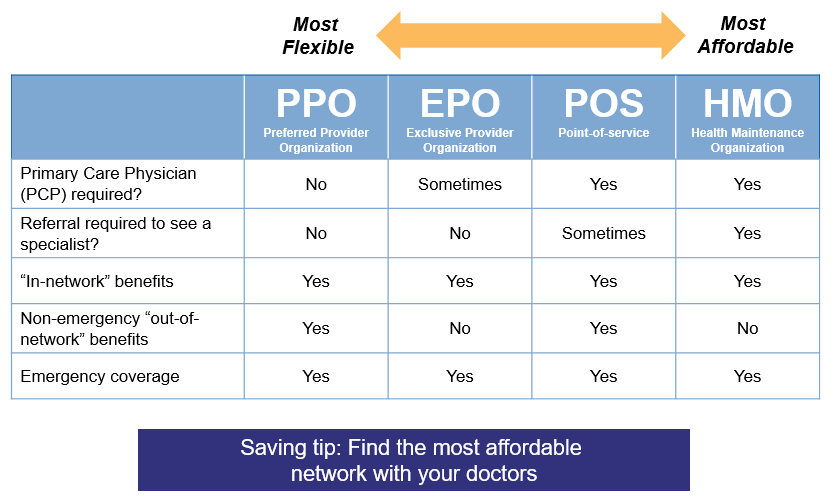

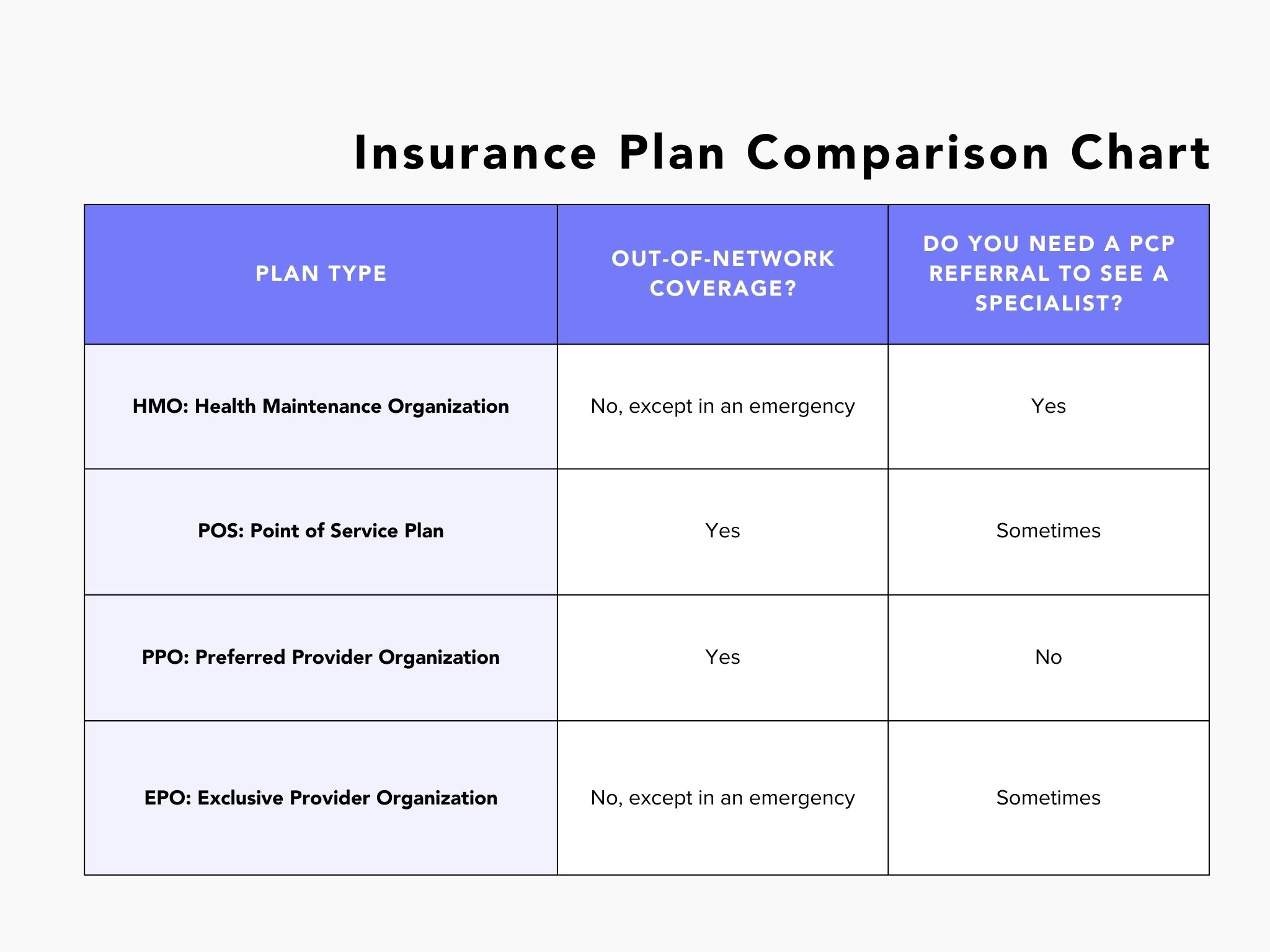

As you're looking for the ideal medical insurance, a good action is to determine which intend type you require. Each plan kind balances your expenses and threats in a different way. Think of your health and wellness treatment usage and budget to discover the one that fits.

Wellness insurance coverage (likewise called health and wellness insurance coverage or a health and wellness plan) assists you pay for medical care. All wellness insurance coverage strategies are various.

More About Paul B Insurance

You can discover plan summaries and get details about health insurance plan for you as well as your children in your state's Medical insurance Industry. This is an on the internet resource established by the Affordable Treatment Act that aids you find and also compare health plans in your state. Each strategy in the Market has a summary that includes what's covered for you and your family.When contrasting health insurance coverage strategies, take a look at these expenses to assist you decide if the strategy is right for you: This is the quantity of money you pay every month for insurance coverage. This is the amount of money you need to spend prior to the strategy starts paying for your healthcare.

Your insurance deductible does not include your premium. (likewise called co-pay). This is the amount of money you spend for each health and wellness treatment service, like a visit to a wellness care supplier. This is the greatest quantity of money you my blog would have to pay yearly for healthcare services. You don't need to pay even more than this quantity, also if the solutions you require price a lot more.

Below's what to look for in a health insurance when you're assuming regarding companies: These service providers have a contract (agreement) with a health insurance plan to provide medical services to you at a discount. In most cases, mosting likely to a favored carrier is the least pricey means to obtain health treatment.

Excitement About Paul B Insurance

This implies a health and wellness plan has various costs for various providers. You might need to pay even more to see some carriers than others. If you or a member of the family currently has a healthcare provider and also you wish to keep seeing them, you can figure out which plans include that provider.

When comparing wellness insurance policy strategies, comprehending the distinctions between medical insurance types can help you pick a navigate to this site strategy that's ideal for you. Medical insurance is not one-size-fits-all, as well as the variety of alternatives shows that. There are a number of sorts of medical insurance prepares to pick from, and also each has associated prices and also restrictions on carriers as well as brows through.

To get in advance of the video game, inspect your existing medical care strategy to evaluate your coverage as well as understand your plan. As well as, examine out for more details healthcare plan info.

The Definitive Guide to Paul B Insurance

If it's an indemnity strategy, what kind? With lots of plan names so unclear, just how can we figure out their type?

A strategy that gets with medical providers, such as hospitals and physicians, to produce a network. Clients pay much less useful source if they use providers that come from the network, or they can utilize suppliers outside the network for a higher expense. A plan comprising groups of healthcare facilities as well as medical professionals that agreement to give thorough clinical solutions.

Such strategies normally have differing insurance coverage levels, based on where service occurs. For instance, the plan pays more for service carried out by a limited set of carriers, much less for solutions in a wide network of service providers, as well as even less for services outside the network. A strategy that gives pre paid extensive treatment.

The 2-Minute Rule for Paul B Insurance

In Exhibition 2, side-by-side contrasts of the six kinds of medical care plans show the distinctions determined by response to the four inquiries concerning the plans' features. As an example, point-of-service is the only plan kind that has greater than two degrees of benefits, and also fee-for-service is the only type that does not use a network.The NCS has not added plan kinds to account for these but has actually identified them right into existing plan types. In 2013, 30 percent of medical strategy individuals in private industry were in plans with high deductibles, as well as of those employees, 42 percent had access to a health savings account.

Report this wiki page